NEW YORK – Coming off a solid 2021 for which the company is projecting year-over-year revenue growth of roughly 27 percent, high-sensitivity immunoassay firm Quanterix sees growing opportunities for its Simoa technology, including in drug development and clinical trial work for Alzheimer's and COVID-19.

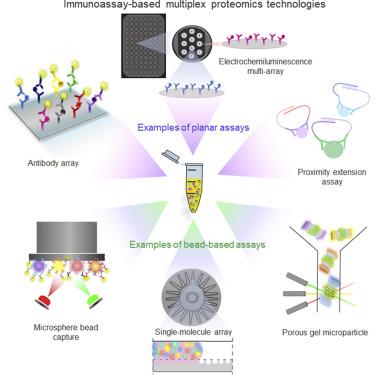

One looming question for the Billerica, Massachusetts-based firm, however, is how emerging single-molecule proteomic technologies could impact its business in years to come. Recent years have seen a number of new entrants in this space, and while many of these technologies could benefit Quanterix by growing the pipeline of new protein markers for use on its platform, their high sensitivity could also make them competitors.

Over the last decade, Quanterix has carved out a niche as a provider of ultra-high-sensitivity immunoassays for research and clinical trials in areas including neurology, oncology, and infectious disease. The high sensitivity of its platforms has made them particularly useful for measuring blood-based protein markers linked to neurological conditions like multiple sclerosis or Alzheimer's disease. With regard to the latter, the approval of Biogen's anti-Alzheimer's drug Aduhelm last year by the US Food and Drug Administration could drive increased usage of Quanterix's platform for helping to evaluate whether patients are good candidates for the drug and for following response to treatment, particularly in the context of clinical trials.

New proteomics platforms from companies like Nautilus Biotechnology, Quantum-Si, Eriyson, Encodia, and Alamar Biosciences, as well as various nanopore-based systems being developed by research groups around the world, also promise to offer extremely high sensitivity. Seattle-based Nautilus, for instance, has published data indicating its system can measure proteins at attomolar concentrations, a sensitivity level similar to that of Quanterix's Simoa technology.

Freemont, California-based Alamar Biosciences is one firm that believes it can play in the high-sensitivity, targeted protein niche currently occupied by Quanterix. Alamar closed an $80 million Series B funding round in September 2021 and inked a strategic partnership with antibody provider Abcam in the beginning of January. Its nucleic acid-linked immune-sandwich assay, or NULISA, platform allows for readout via next-generation sequencing.

Alamar has thus far provided little detail on how its system achieves the very high levels of sensitivity it claims, but Yuling Luo, the firm's founder and CEO, said that in addition to offering highly multiplexed measurements, its technology is "capable of doing what Quanterix does with equal or better sensitivity."

Whether or not that vision is borne out by the performance of the NULISA platform remains to be seen, but Luo's comments do indicate the company is eyeing the ultra-high-sensitivity, targeted protein analysis market that is the core of Quanterix's business.

Parag Mallick, founder and chief scientist of Nautilus, on the other hand, said that his company does not see itself competing in the same space as Quanterix.

"Clinical targeted immunoassays is not an area that we are planning on going into," he said. "Instead, we view that our broad-scale platform will actually open up more opportunity for Quanterix and drive more interest to them, as well."

Mallick said that Nautilus sees as its system's particular advantage the ability to very thoroughly characterize the various proteoforms of a protein. To date, this has been the focus of its research collaboration with pharma firms Genentech and Amgen.

"Understanding the molecular heterogeneity of proteoforms we view as a unique capability of the platform, and so we feel like we should take advantage of that," he said.

Quantum-Si, which along with Nautilus is perhaps the furthest along commercially of this new crop of protein analysis firms, likewise said that while it plans to pursue high-sensitivity targeted protein assays, it doesn't see itself as competing directly with Quanterix.

"I don't think our customer phenotypes will be exactly the same," said Quantum-Si CEO John Stark, noting that, particularly in its early stages, Quantum-Si will be focused more on basic and discovery research while Quanterix has been targeting the clinical research and, increasingly, clinical markets.

Like Mallick, Stark said he believed Quantum-Si's technology could complement Quanterix's by increasing the flow of protein markers to downstream, more clinically focused platforms.

Kevin Hrusovsky, chairman, president, and CEO of Quanterix, also painted such a scenario, suggesting that these new technologies could drive proteomic discoveries that Quanterix could then help translate to the clinic.

"We're very excited about the prospect that they are going to yield new proteins that show value," he said. "Because where we sit in the value chain isn't in that large, multiplex [technology] that is attempting to discover those proteins. We sit at the next step, where if you find one or two or three proteins of interest, you then want to have the ability to interrogate those."

"What we've done is created a high-throughput, scalable, low-cost instrument that has exquisite sensitivity, so you can see those proteins in less invasive samples, and you can see the disease cascade even before symptoms," he said.

Hrusovsky acknowledged, though, that emerging single-molecule technologies could produce competitors to the company. He noted that Quanterix has continued to improve its sensitivity to retain its advantage in this department. In 2020, the company and its collaborators published a study in Lab on a Chip demonstrating a new version of the Simoa technology featuring a 100-fold to 400-fold sensitivity improvement. Hrusovsky said that this 100-fold more sensitive assay would be available as part of the company's service offerings by the end of the year.

The company also believes it can retain a competitive advantage around cost, throughput, and usability, he said. Its flagship HD-X instrument is fully automated and can process a 96-well plate of samples in around 2.5 hours.

Additionally, Hrusovsky said Quanterix's IP position, particularly around some of the antibody pairs it uses in its assays, provides it a measure of protection.

"I do think antibody engineering can lead to sensitivity advances and clinical discrimination advances," he said. He noted, though, that this sort of engineering can be an uncertain and time-consuming process.

"We think that Simoa does give us the ability to get to certain levels of sensitivity and disease specificity without a lot of that antibody engineering, but that doesn't mean antibody engineering can't further enhance what Simoa can do," he said. "So we don't rule out getting great antibody pairs and making sure we are using the best antibody pairs, particularly for assays we want to advance into the clinic."

The clearest example of this is Quanterix's 2019 purchase of Swedish reagents firm UmanDiagnostics, primarily to acquire the company's NfL antibodies. A marker of neurodegeneration being studied in a number of conditions, including multiple sclerosis and Alzheimer's, NfL is one of Quanterix's bestselling assays. At one point in 2019, it accounted for roughly 20 percent of the company's revenues. That percent figure has since dropped as Quanterix's overall business has grown, but its total volume of NfL sales has continued to rise.

"Can [these new firms] become competitors at some point? It depends on whether they ever really attempt to go into where we are trying to go, which is the diagnostic landscape," Hrusovsky said. "Can they be competitive with Roche, Abbott, and Siemens? It's hard to know, but there is a chance, I would say. But there are a lot of factors that go beyond sensitivity."